When inflation soars and the cost-of-living rises, the usual response from consumers is to cut back on spending or adopt financial behaviours that err on the side of caution. Although this trend was also evident for the majority of Gen Zs, we’ve noticed a small but growing number of young people exhibiting “financial fatalism” and are turning away from financially prudent habits, despite economic uncertainty.

A recent report by the Australian Securities and Investments Commission (ASIC) has revealed that Gen Zs are experiencing the highest levels of financial stress and vulnerability compared to other generations. As financial milestones are becoming increasingly unattainable and the economic climate grows more precarious, some young Australians have started turning to retail therapy as a coping mechanism or for instant gratification from their stressors.

Key insights

- The biggest concern for young people is the rising cost-of-living and inflation

- Gen Zs have reined in their spending on most goods and services except for “little luxuries” like entertainment, leisure and cosmetics

- Evidence of divergent financial behaviours: the majority of young Australians have adopted pragmatic financial habits, however a minority are starting to abandon these habits

- Opportunity to ensure that financial advice and information available to young people are credible and accurate

In two of our key studies, the Top Youth 100 Brands Report, and the Student Edge Member Survey, both conducted in 2023, we asked Australian Gen Zs about their biggest challenges, spending habits, and financial preferences.

Biggest challenge – Cost of living and inflation

Inflation and the cost of living has been revealed as Gen Z’s highest stressor, with 72% identifying this as a topic that causes significant concern. Further, given the close link between financial difficulties and declining mental health, it’s not surprising that almost 1 in 2 young Australians are also troubled by mental health challenges and uncertainty about the future.

Gen Z’s Top Challenges and Concern

Spending habits – a decrease in spending across most categories except entertainment, leisure and cosmetics

For many, rising prices means forgoing a range of products and services. This was the most dominant behaviour among young people in Australia:

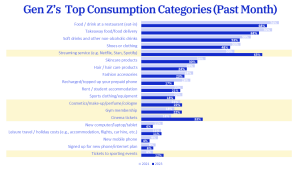

Compared to 2021, Gen Zs have cut back their spending on almost all categories. Although food, drinks, clothing and shoes prevailed as the most purchased items for young Australians across both waves (highlighting their enduring relevance), spending on these items still fell short of 2021 levels. This could be indicative of the effects of inflation creeping into the decision-making processes of Gen Zs.

The few categories that reported a more noticeable increase in spending include streaming services, cinema tickets, tickets to sports events and gym memberships. Perhaps the growing demand for entertainment, social and physical activities since 2021 can be attributed to: society returning to pre-COVID life, the influence of the 2023 FIFA Women’s World Cup, a boom in new and highly anticipated movie releases or perhaps a combination of these. Nevertheless, having experienced multiple crises since 2020, Gen Zs have sought to counter these with more positive, rewarding and memorable experiences.

Gen Z’s Top Consumption Categories (Past Month)

Financial preferences – financially prudent behaviour dominates, but growing incidence of “financial fatalism”

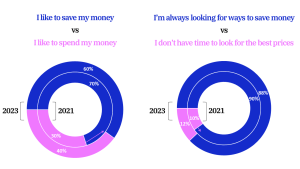

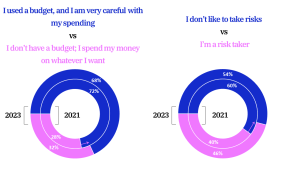

To get a sense of the general financial preferences and tendencies of Gen Zs, we asked respondents to compare several pairs of opposing statements. The majority of young people tended towards financial prudence, and this was evident across both waves.

In 2023, most Gen Zs:

- Liked to save (60%) rather than spend

- Were always on the lookout for ways to save money (88%)

- Used a budget and were very careful with their spending (68%)

- Were risk averse (54%)

However, when looking at how these proportions changed from 2021 to 2023, we observed that a small but growing proportion of Gen Zs have opted to move away from frugal lifestyles. In particular, the proportion of Gen Zs who liked to spend rather than save, grew by 10 percentage points. Further, the proportion of budget users and careful spenders decreased by 4 percentage points and the proportion of risk lovers increased by 6 percentage points.

Gen Z Financial Preferences

Next steps – supporting young people with credible financial information and advice

Gen Zs, being the youngest generation with spending power, are also twice as determined to improve and become more confident with their money management skills, compared to other generations. With that said, it’s crucial that young people are supported with credible and accurate resources that enable them to establish healthy, effective and helpful financial habits for both the present and in the long term.

[…] However, it’ll be important for political parties to consider not just the needs of Gen Z when it comes to student loans, but also their concerns about inflation. […]